The ill Aesthetic

The Tariff Trap: Why Your Style is Caught in a Political Firestorm

**UPDATE** 05.12.25 The U.S. and China have agreed to reduce tariffs to 30%, which is still double the original rate.

Donald Trump’s new tariff policy set your GRWM (Get Ready With Me) algorithm on fire. Gone are the days of 30 TEMU dresses for $30, one-and-done outfits, and the over-the-top mindset of “I can’t wear it again if it’s been posted.” Why? Because, as Young Jeezy once said: “It’s a recession—everybody broke.”

Well, it’s not officially a recession, and you might still be doing just fine—but thanks to Donald Trump’s renewed trade war, staying fresh is about to cost you a lot more. A tariff is basically a tax the government puts on goods coming from other countries. When those taxes hit your favorite brands’ supply chains, it trickles down into your closet.

Welcome to the new era of fashion politics—where the cost of a pair of jeans might depend more on trade policy than runway trends. The luxury market is already cooling off, down 2% in 2024. Sneakers? Down nearly 6%. And now, tariffs are making an already tense retail climate even tougher.

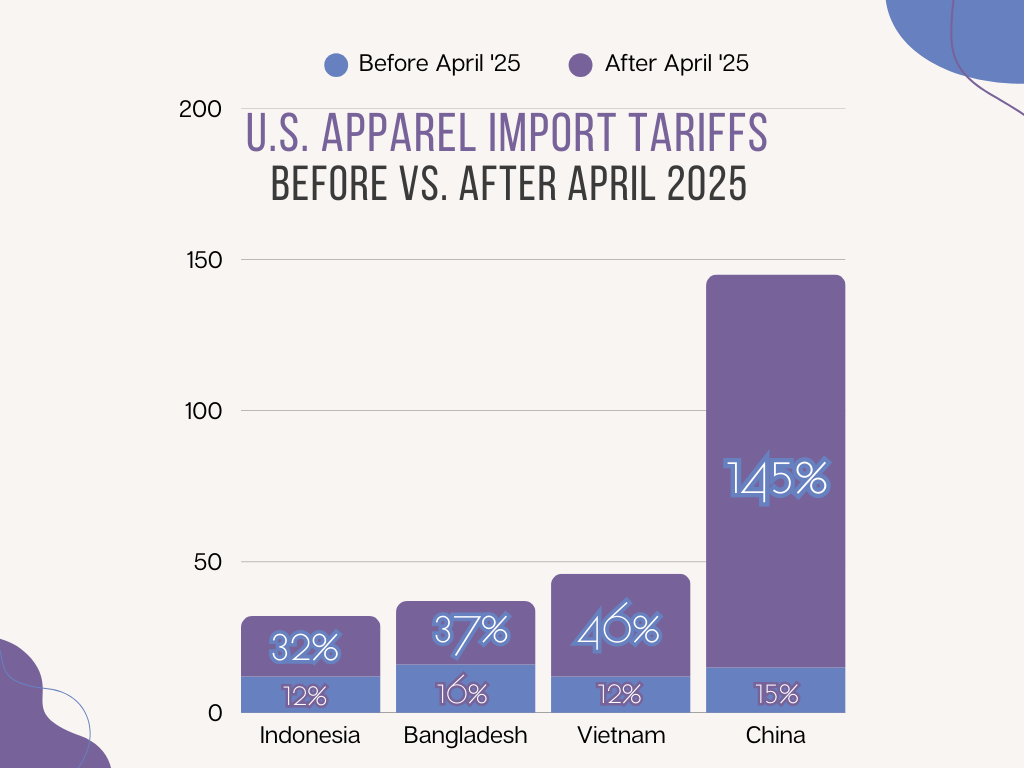

On April 2, Trump announced sweeping “reciprocal” tariffs on imports from major apparel exporters: China (145%), Vietnam (46%), Bangladesh (37%), and Indonesia (32%). Even Japan and the EU, key players in luxury and menswear, weren’t spared. This new policy targets wholesale costs, but the effects will eventually be passed down to retail.

What This Means for You—and Your Closet

Retailers and brands now face a tough call: absorb the added costs and take a hit on profits, or raise prices and risk losing loyal customers (we both know which one they will choose). Whether it’s high-end or fast fashion, everyone’s feeling the pressure. And while wealthy consumers might continue spending, most luxury sales come from everyday shoppers spending under $2,000 a year. That’s not extravagance—that’s thoughtful style.

These aspirational buyers are highly sensitive to price changes. With industry insiders expecting retail prices to rise 12–13% this could mean walking away from that bag or jacket they’ve been saving for – especially when tariff-related markups make these items harder to justify.

Wealthy shoppers may still head to Paris or Milan and take advantage of tax refunds. But for most people, the added cost is real. Plus, the weakening U.S. dollar means imports are more expensive—even when bought from U.S.-based retailers.

Tariffs & Fast Fashion: No One Is Immune

Fast fashion and streetwear are feeling the heat more than most. These companies depend on fast inventory turnover and low-cost international production to stay competitive. However, Trump’s new tariff policies are disrupting that model. The National Retail Federation projects a 20% drop in U.S. apparel imports by the end of 2025, which means fewer products will reach stores and online retailers. At the same time, analysts estimate price increases of up to 40%, forcing brands to either raise prices or reduce inventory. For businesses built on affordability and trend cycles, these shifts will significantly impact how and when they release new collections.

To make matters worse, the de minimis loophole has been shut down. This rule once allowed companies like Temu and Shein to avoid duties on items priced under $800 shipped directly to U.S. customers.

That exemption kept their prices ultra-low and their products flowing freely into American closets. With that door now closed, those same ultra-affordable items are subject to Trump’s tariff policy driving up costs across the board. The result? Fewer drops, higher prices, and a major rethink of what budget-friendly fashion looks like in 2025.

Reshoring Isn’t a Quick Fix

Trump claims the tariffs are about reshoring, bringing manufacturing back to the U.S. But here’s the reality: over 97% of U.S. apparel is imported. America’s garment factories and skilled labor base have declined for decades. You can’t rebuild that overnight. It takes capital, government support, and serious workforce development.

Menswear expert Derek Guy explained the challenge: “To rebuild the garment manufacturing base, you’d need massive investment and a workforce trained from the ground up.” Larger brands might have the resources to adapt, but some of your favorite smaller labels could struggle—or fold.

A Fresh Look Forward

While the changes may seem discouraging, they could spark a shift toward smarter, more intentional style. Consumers are already turning away from microtrends and flash sales, opting instead for lasting pieces and sustainable choices.

2025 may become a turning point. The age of overconsumption is fading. What’s rising in its place is a renewed focus on timeless looks, thoughtful shopping, and building a wardrobe with purpose. In the words of Shawn Carter, it’s “time to separate the platinum from the white gold…Ready Rock from the raw”.

Because style has never been about mass consumption. Style is the joy of finding that one foundational piece you can build a season around. Style is “The Remix”—the ability to make a piece look new by using it differently. Style is You!